June 2022 Economic Update

There is much uncertainty, volatility, and negativity this past month. As always, I provide a few leading economic indicators below and as in previous months, they are not as bad as one might think. Will the health of the economy continue? I do not know, and the “experts” also have no idea.

A quick search and this article came up about “experts”. The top analysts have amassed a collective success rate of 82.7%, as well as an aggregated average return of 13.95% on their stock picks. These figures are far beyond all the other analysts, who delivered an average success rate of 48.02%, and an average return per rating of 0.16% in 2021

I would rather use a “repeatable process”. The basis is data used to provide rankings of ETFs representing Major Asset Class Groups and sub-Groups and ranks them against many other ETFs (Investments) in the same category.

I believe (along with many others) that the stock market is affected disproportionately by emotion. The “expert” think we will have a recession thus fluctuations in the market persist and are possibly exaggerated. However, we must remember that time horizon is the largest factor in how we should be investing, saving, and spending.

The markets were in a tailspin during June. Most client retirement accounts went from 50% to 80% cash and we were able to help avoid some of the losses, however, we will be ready to put this money back to work when we believe the timing is right. One bright spot is short-term fixed income such as treasuries. Because interest rates have been rising, so have some securities such as these backed by the U.S. government. We started to purchase a small amount for some non-retirement accounts in June with short-term maturities. Depending on the overall market conditions over the next month, we could add to the holdings in client accounts.

I hope you remember the reason we have conversations about your financial life is minimize your stress (as much) about the markets and economy as you would have otherwise. I say many times about building a strong foundation, and in these stressful times by doing just this.

On the personal front, I was able to be a guest on a friend’s raft through Westwater Canyon in Utah on the Colorado River. It was a great experience rafting through class III and IV rapids. We also were able to camp on Chambers Lake near Cameron Peak and unfortunately my son Gavin and me as coach lost our flag football game.

Legislation: No major legislative updates, specifical taxes

June Stock Market Summary

Dow -6.7% S&P 400 (Mid Cap) -9.8%

NASDAQ -8.7% Russell 2000 (Small Cap) -8.4%

S&P 500 -8.4%

It was a terrible month and quarter for almost all domestic and international equity markets, with China being the lone exception. For the month of June, the Dow Jones Industrial Average shed -6.7%, the Nasdaq -8.7%, and the S&P 500 -8.4%.

Mid-caps finished the month down -9.8% and small caps declined -8.4%.

In the second quarter of 2022, the Nasdaq gave up -22.4%, the Dow fell -11.3% and the S&P 500 declined -16.4%. Mid-caps and small caps ended the quarter down -15.8% and -17.5%, respectively.

Almost all international markets finished the month to the downside, save one. Canada declined -9%, the UK gave up -5.8%, and France retreated -8.4%. Germany plunged 11.2%, while China rose 6.7%. Japan ended the month down -3.3%. Developed markets declined 8.8% in June, emerging markets shed -5.2%.

Gold and silver finished the month of June down -2.2% and -6.2%, respectively. Oil declined -7.8% and Copper ended the month down -13.6%. In the second quarter, gold shed -7.5%, Silver plunged -19%, and copper collapsed -21.9% but oil rose 5.5%. All data from Yahoo Finance, 7/1/2022

DOMESTIC ECONOMIC HEALTH

The number of Americans filing for first-time unemployment benefits fell by 2,000 to 231,000 last week. Economists had expected claims to total 230,000.

The four-week average of claims, smoothed to iron out the weekly volatility, rose by 7,250 to 231,750—the highest level since December.

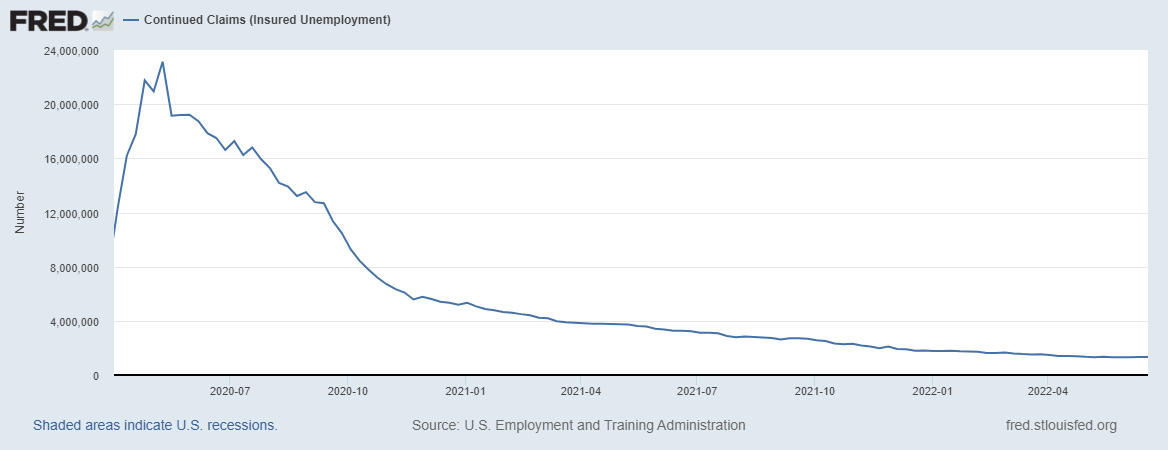

The number of people already collecting jobless benefits, known as continuing claims, fell by 3,000 to 1.33 million. That number is now back to pre-COVID crisis levels. While still robust, many analysts don’t think the labor market can show much improvement from these levels. Nancy Vanden Houten, lead U.S. economist at Oxford Economics stated, “The level of claims is still relatively low, but we don’t expect claims to fall much below the levels of the last few weeks. While labor markets remain very tight, reports of layoffs are increasing.”

Home prices continued to rise in April, according to the latest report from S&P Case-Shiller. The Case-Shiller 20 city home price index posted a 21.2% year-over-year gain in April, up a tick from the 21.1% reading the previous month.

Confidence among the nation’s consumers fell to a 16-month low as the high price of gas and food weighed on sentiment.

A key gauge of inflation rose sharply in May, largely due to the higher cost of gas and food, but there were signs that price pressures may be starting to ease. The ‘personal consumption expenditures index’, or ‘PCE-I’, rose 0.6% in May—triple its reading from April. But a narrower measure of inflation that omits volatile food and energy costs, known as the core PCE, rose by a relatively modest 0.3% for the fourth month in a row.

The economy shrank at a -1.6% annual pace in the first quarter, and according to the Atlanta Fed’s GDPNow tracker, the second quarter isn’t looking much better.

Orders for goods expected to last three years or more, so-called ‘durable goods’, rose last month with a stronger-than-expected reading. The Census Department reported durable goods orders rose 0.7% in May, it’s seventh gain in eight months. The reading showed manufacturers still had plenty of demand for their products, even amid signs the economy was slowing. Core orders, which strip out the often-volatile transportation sector and military equipment, rose 0.5%. Orders for new cars and trucks rose 0.5%, while orders for commercial airplanes declined -1.1%.

Continued Claims

Chart from the St. Louis Federal Reserve Website

Pain at the Car Lot:

It’s not just housing—the average transaction price of new vehicles sold in June hit a new stratospheric record high of $45,844, up 14% from a year ago. As automakers continue to struggle with shortages of key parts and semiconductors in particular, inventories remain near historic lows. Dealers handled the shortages by charging more than list price and filling their lots with only the most expensive vehicles loaded with as many options as possible—and that’s how the ATP (average transaction price) jumped to a new record. Since June 2019, the ATP has spiked by 36%, or by over ten grand per vehicle! (Chart by wolfstreet.com, data by JD Power)

Summary

Our investment and financial planning advice is based on a repeatable process. We attempt to take out the emotional element in the decision-making process. The results will not be perfect 100% of the time but we believe it gives us and you the best chance for success to meet your goals.

It goes without saying that things can change quickly, and we will be ready to make the changes as necessary. This is also why having a great foundation is important as ever and why I believe so much in this idea. Good spending habits, emergency funds, healthy lifestyle are a few

Please reach out with any questions, introductions, or set up a time to do something fun.

Shane Callahan may be reached at 720-696-0265 or Shane@EnduranceWealthPlanning.com

EnduranceWealthPlanning.com

Know someone who could use information like this?

Please feel free to send us their contact information via phone or email.

The short and long-term health of our economy is positive. Value has reduced from 3 to 2

History of the “Market” and where we are today

Past Market Performance is no guarantee of future investment performance or success